Welcome to the world of investing! I know, you are looking for a good platfrom to invest your money to earn profits but you might don’t have the information which brokers can be best for you. If you’re a beginner, you’re probably overwhelmed by the number of online stock brokers available today. I have given my 100s of hours in researching about these brokers so Fear not, I’m here to simplify things for you.

In this blog post, I am going to introduce you to the 15 best online stock brokers for beginners. These brokers are carefully chosen based on factors like zero-cost account opening, low fees, low account minimums, and beginner-friendly platform and rich educational resources. Let’s dive in!

What to look for in an Online Stock Broker

Before jumping into the list, it’s crucial to understand what makes a stock broker ideal for beginners. Here are the top criteria:

- Ease of Use: A simple, intuitive platform for trading.

- Low Fees: Low or zero commissions on trades and no hidden charges.

- Products: Stocks, Bonds, Mutual Funds, ETFs, Derivatives, Commodities, and Crypto.

- Educational Resources: Tutorials, webinars, and guides for learning the ropes.

- Low Minimum Deposits: Brokers with minimal or no deposit requirements are perfect for starting small.

- Customer Support: Responsive support for queries and troubleshooting.

Now that we know what to look for, let’s explore the best brokers for beginners

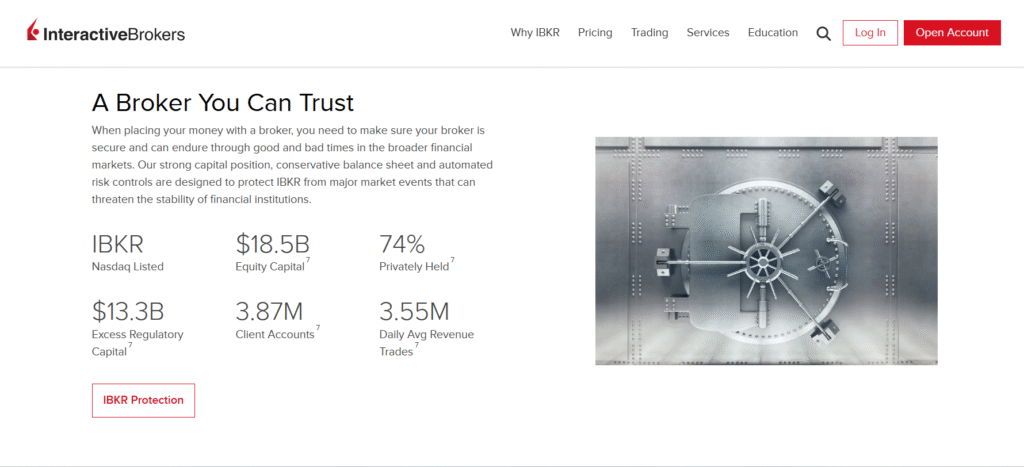

1. Interactive Brokers: Global Reach With Low Costs

What is Interactive Brokers (IBKR) ?

Interactive Brokers (IBKR) is an american multinational largest electronic trading brokerage platform was founded in 1978 in New York city of United States and now the headquartner is in Greenwich, Connecticut, One Chadwick Plaza. Interactive Brokers operates $2.6 millions trades every trading day which is the largest by any electronic trading platform in the United States.

Why is Interactive Brokers great for all levels ?

Interactive Brokers (IBKR) offers low trading fees, a user-friendly platform comes with Web Client Portal, IBKR Desktop, TWS ( Best for Advanced Trader), and three mobiles apps, IBKR mobile, IBKR Global and Impact.

Interactive Brokers have rich educational resources like, Courses, webinars and articles to help beginners and advanced. The IBKR Lite plan pricing features $0 commissions on U.S. listed stock trades, and for IBKR Pro pricing is also fine which is about $0.0005, making it affordable.

Key features of IBKR

- No minimum deposit for IBKR Lite & Pro

- Access to global markets in 200 countries

- Excellent research tools and trading simulators

- Offers wide range of products to trade

- $0 fees for opening an account and no fees for inactive

Interactive Brokers

Best International Brokers

Whether you want to trade U.S. stocks or explore global markets, Interactive Brokers is a reliable choice. Want to know everything about Interactive Brokers, please read the review blog post of Interactive Brokers.

Read more: Interactive Brokers Review 2025

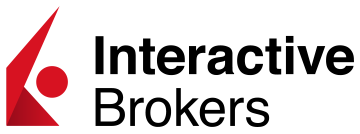

2. Moomoo: Your powerful trading platform

What Is Moomoo?

Moomoo is a global investment online stock brokerage and trading platform with 27 millions user base worldwide. Moomoo was founded in 2018 in silcon valley, headquartered in Palo Alto, California. Moomoo owned by Futu Holdings Ltd., a Nasdaq-listed fintech company

Global Reach

Moomoo is a rising star as online stock brokerage in the world. Moomoo currently operate it’s services from U.S, Australia, New Zealand, Canada, Japan, Singapore, Malaysia, and china with siter brand Futubull. Moomoo is planning to expand their market locations in many countries in the future.

The power of moomoo trading platform is their 27 millions user worldwide, with $109 Billions client assets and $990 Billions in annual trading volume. The best part of moomoo is currently partnership With NASDAQ, NYSE, and CBOE.

Key Features of Moomoo

- Trade U.S, Australia, New Zealand, China, Hong Kong, Singapore, Malaysian Canada, and Japan stocks, ETFs, Crypto, and options from one single account.

- Paper Trading available at moomoo platform, Great for novice without risking real money in the market.

- $0 Commission-free trading and low cost access, Stocks, ETFs, and options.

- The Best of Moomo: The powerful charts, Stock analysis, Level 2 Data available.

- Moomoo Ai: Ask anything related to platform, doubt, about financial products or fundamental analysis.

- Community: Opportunity to interact with millions of traders and investor through community to learn and improve investment and trading skills.

Pros and Cons of Moomoo

Moomoo

Powerful Trading platform

In conclusion, Moomoo is a great fit for all who wants to have all in one experience in single platform such as Education, Charts, Analytics, Commission free trade, Papertrade, fractional share and vibrant community to learn and improve investing experience. still have a doubt just read the artilce of Moomoo review.

Read more: Moomoo review

3. EToro: Social Trading Made Easy

What is Etoro?

EToro is a social trading and multi-asset investment platform where everyone can trade and invest in Stocks, Exchange traded funds (ETFs), forex, commodities, and cryptocurrency in a simple and transparent way.

Key features of Etoro

- Commission-free stock trading

- Copy trading for learning from experts

- Cryptocurrency options

- Etoro offering services in 140+ countries with 35+ millions users

- Crypto Wallet (Etoro Money): Easy to recieve, send and hold cyptocurrency

- Products to trade: Stocks, ETFs, Forex, commodities, and Crptocurrency

- Quality Education and Community: Learn from both medium to become a good investor and traders

Pros and Cons of Etoro

Etoro

Social Trading Made Easy

Final Verdict: EToro is perfect for beginners interested in social trading. It can allows you to trade multiple products on global market. It has 35+ millions user worldwide and following these advanced and expericed trader can help you to learn about investing.

Read more: Etoro review

4. Webull: Zero Commissions and Modern Features

What is Webull?

Webull is a free commission electronic trading platfrom and multinational stock brokerage. Webull is quite popular for its modern trading platform and tools which make an easy for the individual to invest in wide range of products through its mobile app and desktop platform.

Why traders and investors love Webull so much. Here is the list of features

Key features:

- $0 commissions on stocks, ETFs, and options

- Fractional shares Available

- Crypto Trading Available

- Education and research available

- Wide range of assets to trade

- Advanced trading charts and analytics

Pros and Cons of Webull

Webull

Invest Confidently with Webull

Final verdict: Webull is perfect for tech-savvy beginners who want a modern trading experience with ease.

Read more: Webull review

5. Tiger Brokers: Invest in what matters

What is Tiger Brokers?

Tiger Brokers is a global online electronic trading platform and stock brokerage founded in 2014 in Beijing china and now headquartered in Singapore under its parent company Fintech Holding Ltd. Tiger Brokers on 20th march 2019, it went public on NASDAQ under the ticker TIGR with $8 issue price.

The company serves over 2 millions users globally and over the years its getting popular in Asia as the company focus more on U.S and Asian market. If you belong to asia region then it can life changing for you and see if, it really meet your requirements.

Key Features of Tiger Brokers

- Trade across multiple global markets (U.S., HK, Singapore, Australia, China, etc.) using a single account.

- Advanced trading tools: Tiger brokers has great trading tools and resources for traders

- Competitive fee structure: No inactivity, or platform fees, very low commissions.

- Supports diverse asset classes: stocks, ETFs, options, futures, warrants, mutual funds, and more.

- Education and Ai: Tiger brokers comes with outsanding educational content and TigerGPT Ai which can help you in investing research.

Pros and Cons of Tiger Borkers

Tiger Brokers

Money never sleeps

Final Verdict: Best for asian market and it could best brokers if you belong to Asia, Tiger brokers comes with amazing trading tools which makes easy for traders and investor.

Read more: Tiger Bokers review

6. Robinhood: Simplicity at Its Best

What is Robinhood?

Robinhood is a U.S.-based stock brokerage known for commission-free trading of stocks, ETFs, options, and cryptocurrencies, Robinhood is quite famous among the retail investor for mobile first platform since its fouding in 2013. The company is a member of SIPC, giving investors protection up to $500,00. Robinhood reached a significant milestone to being addes in S&P 500 index on September 22, 2025, falls under 500 valuable company in the United States.

Key features of Robinhood

- $0 commissions on all trades

- famous for mobile simplicity

- Fractional shares available

- Cryptocurrency trading

- Serves in US and UK as of now

- Offers high interest rate over uninvested funds

- Get an opportunity to participate in IPO Access

- Robinhood Gold: A $5/m premium tier offering margin, and research tools

- Robinhood bank and asset management system launching soon

Pros and Cons of Robinhood

Robinhood

A new generation of investors

Final Verdict: Robinhood is well know for its simple mobile UI, Free commision trades on all types trading, IPO access without any barriers, and Technological innovations. Seeking for simplicity rather than complexity, Robinhood will great choice for you as Robinhood launching soon banking features and robo-advisory in one sinle platform.

Read more: Robinhood review

7. CapTrader: Global Reach for Beginners

What is CapTrader?

CapTrader is a German based online stock brokerage, based in Düsseldorf that has been active on the market for over 14 years. CapTrader is an introducing broker of Interactive Brokers (IBKR) that offers you to trade global market. CapTrader has over 1.2 million securities across 150 exchanges in 36 coutries and regulated by top tier authorities.

Key features of CapTrader

- Global market access with 1.2 million securities

- Competitive commission rates

- Best trading platforms: Desktop portal, Mobile App, and IBKR’ Trader Workstation (TWS)

- Trade wide range of asset on global market

- Advanced trading tools and educational contenet

- Offers multiple account types

- Demo account for practice

Pros and Cons of CapTrader

CapTrader

Your Broker for worldwide trading

Final Verdict: CapTrader is a strong and reliable broker for for global-minded investors who value broad access market, products and top-tier tools.

Read more: CapTrader review

8. Charles Schwab: Versatile and Comprehensive

What is Charles Schwab?

Charles Schwab is an American multinational well known financial services company in the United States. The Charles Schwab offering offering brokerage, banking, retirement, advisory, and wealth management services. Charles Shwab Corporation was founded in 1971, by Charles R. Schwab in San Francisco, California, United States.

Charles Schwab is a publick traded company in NYSE under the ticker name (NYSE: SCHW). The company is on the list of largest banks in the United States by total client assets. Charles Schwab have $10.10 trillion in client assets, 36.5 million active brokerage accounts, and its merger with TD Ameritrade stock brokerage in 2020.

Key features of Charles Schwab

- $0 commissions on stocks and ETFs

- Fractional shares via Stock Slices

- Access to live support and chat and phone calls

- Over 37 million brokerage accounts

- Banking Services: Checking, savings, credit cards, mortgages

- Wealth Management: Financial advisors for high-net-worth clients

- Retirement Accounts: IRAs (Traditional, Roth, Rollover) and 401(k) plans

- Research Tools: Stock screeners, third-party reports, real-time data

- Robo-Advisory: Schwab Intelligent Portfolios (automated investing)

Pros and Cons of Charles Schwab

Charles Schwab

Own your money tomorrow

Final Verdict: Charles Schwab is a well-rounded choice for new investors as it is seen safe, reliable, stable and friendly investoment stock brokerage and offers everything in just single platform.

Read more: Charles Schwab review

9. E*TRADE: Robust Platform with Learning Resources

What is E*TRADE?

E*TRADE is an online stock brokerage electronic trading platfrom was founded in 1982 in Palo Alto, California, United States. It offers various trading and investment services such Stocks, ETFs, mutual funds, options, futures,bonds, etc. E*TRADE combines a powerful platform with extensive educational resources, including webinars and video tutorials. In October 2020, the company was acquired by Morgan Stanley.

Key features of E*TRADE

- $0 commissions on stocks and ETFs

- Advanced trading platforms and apps

- Educational resources and tools

- Millions of assets available to trade

- A wide range of mutual funds

Pros and Cons of E*TRADE

E*TRADE

Unlock your full financial potential

Final verdict: E*TRADE’s beginner-friendly interface and tools make it one of the top choices for first-time investors.

Read more: E*TRADE review

10. Sofi: It’s time to switch

What is Sofi?

Our Pick

SoFi (short for Social Finance, Inc.) is a U.S.-based fintech / financial services company offering a variety of products: banking, loans, mortgages, investing, etc. SoFi Was founded in 2011 by SoFi, short for Social Finance, was founded at Stanford University 2011.

The four founders students who met at the Stanford Graduate School of Business. The founders hoped SoFi could provide more affordable options for those taking on debt to fund their education. Later, SoFi expaned their operation into multiple sectors.

Key Features of SoFi

- U.S and HK markets access

- Zero commission trades on most of the product

- Advanced trading tools and educational resources

- Fractional shares available

- Supported multiple investing account types

- Automated investing and IPO access

Pros and Cons of Sofi

SoFi

Your money works better when it’s all in one app

Final verdict: Great for beginners, casual investors, people who want a low-cost, simple way to get started. SoFi gives good value. Especially useful if you want one platform for banking + investing etc.

Read more: SoFi review

11. Fidelity: Low Costs and Best-In-Class Research

What is Fidelity?

Fidelity is a large, well-established U.S. financial services company offering stock brokerage, mutual funds, retirement (401(k), IRAs), wealth management, and related services. Extensive research tools, and a platform that caters to all experience levels. It also offers fractional shares, allowing you to invest small amounts. The company is one of the largest asset managers in the world, with $6.4 trillion amout value.

Key features of Fidelity

- $0 commissions on stocks and ETFs

- No account minimums

- Comprehensive educational content

- Advanced trading tools and resources

- Amazing customer support through chat and phone calls

- Fractional shares available

- Multiple account types supported

Pros and Cons of Fidelity

Fidelity

Your goals, your future, your way

Final Verdict: Fidelity is perfect for beginners who want to grow their knowledge while building their portfolio with good reliability, excellent research, and relatively low fees, Fidelity is one of the top choices among U.S. brokers.

Read more: Fidelity review

12. Questrade: For Beginners Interested in Options

What is Questrade?

Questrade is a Canada’s largest growing stock brokerage firm was founded in 1999 by Edward Kholodenko. It provides self-directed trading of stocks, ETFs, options, mutual funds, bonds, etc. Questrade has expanded their services in robo-advising with its Questwealth Portfolios.

Key features of Questrade

- Trade stocks and ETFs commission-free

- Advanced trading platforms and research tools

- Robo-advisry with Questwaelth portfolios

- Multiple account types supported

- No account minimums

- Extensive video library for learning options trading

Pros and Cons of Questrade

Questrade

Keep more of your money

Final Verdict: Questrade simplifies options trading, making it accessible to newcomers. Best for Canadian investor who wants a low-cost, self-directed broker, or a “middle-ground” investor who sometimes trades and sometimes holds for long term, Questrade is very appealing.

Read more: Questrade review

13. Zacks Trade: Research-Focused Platform

What is Zacks Trade?

Zacks Trade is an online brokerage (an introducing broker) in the U.S. that gives investors access to many trading tools, research, international markets, and making it a great choice for those who want to dive deep into stock analysis. Its platform is straightforward and supports global investing.

Key features of Zacks Trade

- Access to extensive research reports

- Commission free stocks and ETF

- Competitive commission structure

- Advanced Trading tools

- Excellent edycational content

- No inactivity fees

Pros and Cons of Zacks

Zacks Trade

Simple way of investing

Final Verdict: Zacks Trade know for strong research and beginner platform with variety of aasets to trade in international markets without any hidden cost can be good who prioritize research.

Read more: Zacks Trade review

14. Ally Invest: Affordable and Beginner-Friendly

What is Ally Invest?

Ally Invest is the U.S Stock brokerage/investment arm of Ally Financial and it offers various investment instruments including, Self-directed trading, automated investing and personal advice.

Key features of Ally Invest

- $0 commissions on stocks and ETFs

- Advanced Trading platforms

- Great financial education

- Excellent customer support 24/7

- No account minimums

- Integration with Ally Bank

Pros and Cons of Ally Invest

Ally Invest

Easy of way investing

Final Verdict: Ally Invest makes managing money and investments simple through their various investment products.

Read more: Ally Invest review

15. Firstrade: Great for Commission-Free Trades

What is Firstrade?

Firstrade Securities is a U.S.-based stock brokerage was founded in 1985 by John Liu and offers commission-free trades across stocks, ETFs, options, and mutual funds. Its educational tools are also designed with beginners in mind.

Key features of Firstrade

- $0 commission on stocks, ETFs, options, mutual funds

- Wide range of investment products to trade

- Multiple account types supported

- Advnced trading platforms

- No inactivity fees

- Free tools for learning about investments

Pros and cons of Firstrade

Firstrade

Learn to Invest Smarter

Final verdict: Firstrade is a great choice for cost-conscious beginners.

Read more: Firstrade review

Final Thoughts: Choosing the Right Broker for You

The best online stock broker for beginners depends on your specific needs. Are you looking for the lowest fees? Or do you value educational resources? Perhaps you want a broker with an easy-to-use app like Moomoo or a globally recognized name like Interactive Brokers.