If you’ve been searching for stock advice websites, chances are you’ve come across The Motley Fool. Since it first launched in 1993, The Motley Fool has built a reputation for giving regular investors the tools, knowledge, and confidence to grow their portfolios in the stock market. I keep spotting their recommendations and advice all over finance forums and investing communities. Their Stock Advisor and Rule Breakers services are mentioned a lot, and their approach to long-term investing has helped a big community of members.

Here’s a quick look at my personal evaluation of The Motley Fool’s most popular subscription services and what you need to know before jumping in:

- Company Name: The Motley Fool

- Website URL: fool.com

- Price: Stock Advisor $199/year (often discounted), Rule Breakers $299/year, other services vary

- Founders: David Gardner, Tom Gardner

- Community: 1+ million members/subscribers (as of 2024)

- Overall Rating: 4.7/5

- Trustpilot Consumer Rating: 3.9/5

- Research Tools: 4.5/5

- Customer Support: 4/5

- Investor Resources: 5/5

- Special Offers: Frequent trials/promo deals

- Ownership: Privately held; main owners are Tom and David Gardner, along with longtime staffers and investors.

Free Content: Yes. Check out daily news, free reports, and investing guides!

The Motley Fool keeps its advice pretty straightforward. They’ve got a specific philosophy focused on long-term stock picks. Think holding quality businesses for several years rather than trying to time the market. Their recommendations cover U.S. stocks, some international companies, and dozens of free educational resources for beginners. I’ve found their approach really encourages patience, discipline, and a focus on high-conviction ideas, which is pretty neat in a world obsessed with day trading and quick wins.

So, let’s now have a look at the features I think you’ll really like and cover the fine details, including what I like, where I think Motley Fool could do better, and whether their paid services are really worth it for regular folks like me. If you’ve ever wondered how their model works or what sets them apart from others, let’s check it out below.

Who Owns The Motley Fool? Meet the Founders and Team

The Motley Fool comes from a background rooted in family. Brothers David and Tom Gardner started the company out of their Virginia home in the early 90s. They wanted to demystify stock investing and make Wall Street info way more accessible for everyday people. Both spent years learning the ropes from their dad, who was a financial journalist, and they actually started out by running a simple newsletter before expanding to radio segments and finally their sprawling Fool.com website.

Over the years, Tom Gardner has stayed on as CEO, while David Gardner has focused on content oversight and investment strategy, especially for their premium research teams. The company is still private, mainly owned by the founding Gardner brothers plus longtime team members through employee stock programs. This private structure helps them avoid the short-term thinking that publicly traded financial info companies sometimes face.

The Fool’s headquarters is still based in Alexandria, Virginia, but their team and contributors are scattered across the U.S. and even in the U.K. They have writers who focus on nearly every aspect of investing: stocks, ETFs, mutual funds, retirement, crypto, and even financial news, so you get a wellrounded perspective.

Worth knowing: The Motley Fool sticks to a clear line between editorial recommendations and business operations. This helps keep their paid picks unbiased (at least in theory). They also require staffers to wait several days after stock recommendations before they can buy or sell personal shares, which is another step to protect members.

So if you’re wondering who the big players behind the website are, it’s really still very much the Gardner family at its core, with trusted company veterans guiding research and product management. The culture stays focused on putting the customer first and pushing toward long-term success.

What Services Does The Motley Fool Offer?

The Motley Fool does a lot more than free news and market analysis. Their main value comes from premium research services and newsletters—basically, they pick stocks and send alerts to members who pay an annual fee.

- Stock Advisor – Their flagship service since 2002. Gives two new stock picks every month, plus updates on recommended stocks, Buy/Sell notifications, and access to a list of “Starter Stocks” for beginners.

- Rule Breakers – Focuses on companies with strong growth potential, emphasizing tech and innovators. Two picks a month, updates, indepth reports, and a monthly “Best Buys Now” list.

- Everlasting Stocks, Epic Bundle, and Other Newsletters – Each newsletter follows a slightly different strategy. Some target dividend stocks, others focus on international companies or smallcaps. Price points and content can vary quite a bit.

- SelfDirected Investor Tools – Stock screener, watchlists, and interactive tools (mostly available for paid members).

- Free Content – Daily articles, breaking news, investment guides, and entertaining podcasts. Good for beginners wanting to get the lay of the land.

Each service comes with its own set of portfolio recommendations and regular email updates. Stock Advisor is by far their most popular service, and a lot of newbies start there before deciding if they want to branch out into more specialized stuff.

It’s pretty handy if you want expertlevel research but don’t want to spend hours digging around company filings every weekend. They basically give you a blueprint of which stocks they like and why, and you can watch how their portfolios perform over time. There’s also a clear, no-pressure vibe. If you want to follow their picks, go for it. If not, their educational material is still there for you, supplying value through free guides and podcasts that break down stock basics and investing psychology.

Inside the Motley Fool Philosophy: How They Pick Stocks

The Motley Fool is really big on the idea that anyone can learn to invest successfully. And honestly, compared to some finance websites that overcomplicate things with charts and jargon, the Fool’s core message is refreshingly simple: identify great companies, buy their stock at reasonable prices, and hold onto them for several years (ideally, at least five).

- LongTerm Focus: Most recommendations are designed for 3-5+ year time horizons.

- Quality First: They screen for companies with strong leadership, growth potential, a solid business model, and sometimes a “network effect” or other unique edge.

- Scientific (Sort Of!): They use both quantitative data (earnings, revenue growth, profit margins) and qualitative research (news analysis, management interviews, big consumer trends).

- Growth and “Rule Breakers”: There’s extra love for disruptors—companies changing how an industry works, or riding the next big trend before everyone else catches on.

They’re upfront about the fact that not every stock pick will skyrocket. In fact, some lose money. The swingforthefences approach means their big winners often make up for a few losers, which lines up with academic research on how stock markets really work. If you’re the kind of investor who freaks out if a recommendation drops by 15% in a month, this approach might feel uncomfortable at first. But over time, the math of holding winners really does play out, especially looking back at their early2000s picks like Amazon, Netflix, and Tesla.

When you join a premium Motley Fool service, you get breakdowns on why they picked a company, what could go wrong, and the logic behind price targets (if they give them, which isn’t super common). I like that it’s not just about the numbers—they include plainEnglish explanations so you can build your understanding along the way. This mix of storytelling and data helps even total beginners get a handle on why one stock might outpace another down the line.

How Do Motley Fool Alerts Work? (Buy, Sell, and Hold Guidance)

One of the most common questions I see from new Fool members is whether The Motley Fool tells you when to sell, or if they just feed you new picks without any exit strategy. Here’s my experience with their approach:

- You get a fresh batch of stock recommendations every month with a full writeup (I usually get the alert by email and it’s also on the member dashboard).

- They send “Buy” notifications, but they rarely (almost never) send a “Sell Now!” panic button as soon as news hits.

- If a stock’s business fundamentally changes, or if they make a real mistake in analysis, they’ll issue a Sell alert. These are clear, simple emails explaining what changed and why they think it’s time to move on.

- For most of their picks, though, you’ll get “Hold” updates that reassure you whenever there’s a price drop, as long as the thesis is still intact. They basically tell you when to stay the course, and why they’re doing the same with their own portfolios.

- Some monthly updates also include rankings, so if you want to build a portfolio starting now (not in 2002 when they recommended Amazon!), you can choose from their “Best Buys Now” or “Starter Stocks” lists.

This approach puts way more responsibility in your hands compared to active day trading newsletters. The Fool wants you to understand that investing isn’t about catching every peak and valley, but about building wealth by being patient with your winners, cutting losers when the thesis is busted, and holding through the usual volatility.

I’ve personally found their Sell notifications to be rare, but when they happen, they’re clear and well explained. For most stocks, the message is don’t sweat short-term noise. If you trust the original story and nothing has fundamentally changed, they want you to hang on, sometimes for years. This “hold tight” philosophy is central to the consistency of their messaging and critical for building long-term wealth.

Does The Motley Fool Use the Rule of 72?

This is a question that comes up a lot: “What is the rule of 72 Motley Fool?” The Rule of 72 is a handy little math shortcut that helps you estimate how long it’ll take for an investment to double, given a fixed annual rate of return. You just divide 72 by the percentage rate, so an average 8% annual return doubles in roughly nine years (72 ÷ 8 = 9). Motley Fool writers actually use this formula sometimes in their educational guides and newsletters, especially when helping new investors set realistic expectations about compounding.

It’s not exclusive to The Motley Fool. Financial planners use it all the time, but you will see The Fool refer to it in their retirement and savings articles. They use it as a way to show how even “average” stock market returns add up over time, another nudge for the patient, long-term investor approach. If you ever see it mentioned in their materials, just remember: it’s a tool for quick mental math, not a guarantee of future results.

How Does Motley Fool Stack Up as a Stock Advice Website?

If you want to know the best stock advice website, there’s no single answer. Stock advice is different for everyone based on experience, how much money you’re investing, and how handson you want to be. But here’s a direct comparison of what The Motley Fool does well compared to its top competitors:

- Research Quality: Motley Fool puts in the work. Their picks are supported by clear reasoning, thorough breakdowns, and ongoing coverage. They aren’t just tossing out tickers—you get the logic behind every move.

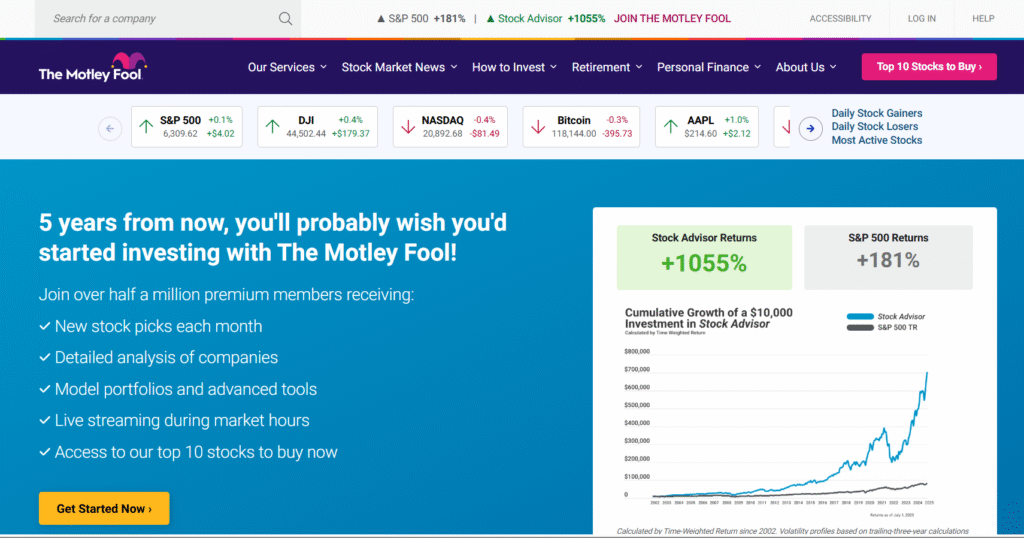

- Track Record: Stock Advisor’s historical returns beat the S&P 500 by a wide margin (over 400% returns since 2002, compared to about 120% for the market, as of early 2024). Of course, past results don’t guarantee future returns, so take these numbers as a track record, not a sure thing.

- Beginner Friendly: Their site is approachable, the onboarding is super easy, and they’ve got a lot of free guides if you’re just getting started.

- Transparency: They disclose conflicts, and most writers personally invest in the stocks they recommend (with appropriate waiting periods).

- Community and Education: Discussion boards, podcasts, explainer articles, and even a membersonly forum for premium subscribers.

Competitors like Zacks, Morningstar, and Seeking Alpha have some solid research tools, and sites like Yahoo Finance are pretty accessible. But The Motley Fool stands out because it blends professional research, community, and a plain-language communication style. I personally think it’s a solid place to get inspiration for stock research and portfoliobuilding, but always remember to do your own research, too. If you want more technical breakdowns or prefer pure data tables, some of the other options might catch your eye. Still, The Fool’s community and story-driven approach are tough to match for most beginners and busy investors.

Real Results: Success Stories and Criticism

I’m always skeptical of marketing hype, so I went looking for real reviews and success stories from actual Motley Fool members. Here’s what I noticed:

- Success Stories: Members who bought early on picks like Netflix, Amazon, and Google have seen jaw-dropping gains. Testimonials often highlight massive outperformance when following Fool picks for several years, not months.

- Criticism: Some reviewers complain about too many upsells and adheavy emails after joining. Occasionally, there’s frustration about recommendations for highflying stocks that got crushed in market downturns. Growth stocks are volatile, and Fool picks are not immune to that.

- Refunds: Most services have a 30day moneyback guarantee, which helps if you join but realize it’s not a fit.

- Customer Service: Usually responsive, but not always quick if you have billing or website login issues during sales periods.

On balance, Motley Fool gets high marks for accessible advice, but it’s not perfect. No stock picking service is, and anyone promising 100% winning picks is probably not being straight. But if you want credible, easy-to-digest research with a real focus on the long term, the Fool is tough to beat. Every investing service will have some unhappy customers, usually because expectations didn’t line up with reality. Still, the pros outweigh the cons here, especially for those with long time horizons.

Expert Analysis: What Do the Pros Say?

Financial pros sometimes poke fun at Motley Fool’s marketing, but they almost always give it respect as an “above average” advisory firm. Not everyone agrees with every pick, and some advisors say The Fool’s tech and growth stock focus can be risky for new investors. But most recognize their research is independent, well-documented, and updated regularly.

Morningstar and Zacks are often seen as more “institutional” with huge, detailed reports for data nerds. Motley Fool, on the other hand, is more approachable, opinionated, and community-driven. Your ideal stock advice website really depends on your learning style. If you want bite-sized, actionable stock tips and aren’t afraid of a little stockpicking risk, Motley Fool probably makes sense for you.

Here are a few resources you might check for independent coverage of Motley Fool:

- Investopedia on Motley Fool Stock Advisor

- Motley Fool Reviews on Trustpilot

- Business Insider’s Motley Fool Review

Who Should (and Shouldn’t) Use Motley Fool?

Here’s who I think will get the most out of a Motley Fool premium service:

- DIY Investors: You want to build and manage your own stock portfolio with proven research, but don’t have days to spend studying finance books.

- Intermediate Investors: You already own some stocks or ETFs and want more direction and updated recommendations on where to put new money.

- LongTerm Thinkers: If you’re comfortable ignoring shortterm market noise, you’ll gel with their “buy and hold” approach.

- Anyone Tired of Financial Jargon: Their reports are written in plain English. Anyone can understand them—even if you’re starting from scratch.

Motley Fool probably isn’t right for you if:

- You want detailed options, crypto, or day trading strategies. They focus almost entirely on stocks.

- You need daily trade alerts or want to actively buy or sell every week (Fool picks are for monthly or quarterly adjusting).

- You panic easily during market drops. Holding through volatility is key, and the Fool hammers this point home.

Key Features: Where Motley Fool Stands Out

- Proven Stock Picks: Their model portfolios are fully transparent, and you can access years of historical data to see how picks have held up.

- Starter Stocks: Great for beginners. These are lowervolatility, bluechip companies to help new investors build confidence.

- Buy & Sell Guidance: Ongoing updates, so you aren’t left wondering what to do after buying a new stock.

- Performance Tracking: See how individual picks and the entire portfolio are doing compared to the S&P 500.

- Community Forum: Paid members get access to a private, moderated discussion room to swap ideas, ask questions, and share experiences.

- MultiService Bundles: If you decide you want investment ideas from several Fool teams, the “Epic Bundle” lets you save money by subscribing to a package of services.

- Free Education: Everyone can access Fool U, podcasts, and free articles filled with practical investing tips. Even if you never pay, you’ll probably learn something new.

Motley Fool Pricing: What Does It Really Cost?

It actually surprises a lot of people that Motley Fool is one of the more affordable “stock picker” services out there. Here’s what you can expect (all prices current as of 2024, but subject to change, and watch for sales):

- Stock Advisor: $199/year (often can get it for $79-$99 in first year sales)

- Rule Breakers: $299/year (sometimes discounted, bundles available)

- Epic Bundle: $499/year for Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners combined

- Individual Newsletters: Most range from $199-$399 per year—check the current offerings

You’ll need to sign up and pay for each newsletter or bundle you want. Some people get frustrated by upsells, but honestly, it’s all about knowing what you want. You don’t need every service to get solid results; Stock Advisor alone is plenty for most people just starting out.

They offer a 30day moneyback guarantee on most products, so if you join and realize it’s not a fit, hitting the refund button is pretty painless. Review all current bundle deals and sales at their official website prior to signing up, and consider what level of service is needed for your goals.

My Personal Experience (and What Other Users Say)

I tried Motley Fool Stock Advisor for myself to get a sense of what the average user would experience. Right away, I found onboarding super easy. There are no long forms, immediate access to current and historical pick lists, and a welcome email that spells everything out in plain English. You get a list of current “Best Buys Now,” a table of all open positions, and a member dashboard for tracking.

The membersonly reports break down each pick with the “why,” giving both the positive thesis and a “what could go wrong” section. I liked that they encourage you to build a diversified portfolio, not to bet the farm on one or two stocks. I also appreciate the regular updates (at least monthly), which help keep investments top of mind without feeling overwhelming, unlike the constant day trader noise on other finance sites.

From what I’ve seen in Facebook groups and Reddit threads, other users echo the ease of use, educational value, and solid performance for those sticking with a long-term plan. Complaints focus mostly on the frequent marketing emails after joining. This is something to be aware of if your inbox is sacred space! The balance of user opinions definitely tilts positive though, especially among investors committed to holding for years instead of chasing quick wins.

Tips for Getting the Most Out of Your Motley Fool Subscription

- Start small. Use the “Starter Stocks” or “Best Buys Now” lists if you’re new—don’t rush to buy every pick right away.

- Read the rationale. Look beyond the ticker and study the “why” for each pick. The Fool’s value is in their research, not just their recommendations.

- Stay diversified. Spread your bets (they recommend holding at least 25 stocks if you can).

- Don’t panic. Shortterm drops are normal. The Fool’s picks are designed to be held for years.

- Set up notifications. Make sure you’re getting emails or app alerts about updates, new picks, and potential sells.

- Get involved with the community. Jump into the premium forum to ask questions and learn from others. There’s a ton of practical advice and lessons from real investors in there.

Alternatives: What Other Stock Advice Sites Are Out There?

Motley Fool is probably the biggest name in “mainstream” stock research for individuals, but there are other options. If you want more choices, here are some sites I’ve tested or seen recommended often:

- Morningstar: Focuses on mutual funds, ETFs, and longform analysis; super useful if you love data and ratings.

- Zacks Investment Research: Known for shortterm timing and “Zacks Rank” system, but reports are pretty technical.

- Seeking Alpha: Huge communitypowered research site with both free and paid content; voices from bulls and bears on every stock, so you get multiple viewpoints.

- Yahoo Finance Premium: Data dashboards, portfolio tracking, and handy alerts. It’s a little weaker on original research compared to the Fool, but good for DIY folks.

- Trade Ideas and Stock Rover: More advanced research tools and screeners, great for active investors or pros.

If you like stepbystep instructions and want a “set it and forget it” solution, Motley Fool is a great first stop. Those who want nextlevel cool data or daily trade ideas might vibe better with one of the more technical alternatives above.

Frequently Asked Questions About Motley Fool

What is the rule of 72 Motley Fool?

The Rule of 72 is a quick math trick for estimating how long it takes an investment to double. The Motley Fool sometimes uses it in articles and guides to show why long-term compounding works, even with average stock market returns.

Does Motley Fool tell you when to sell?

Yes, but rarely. They only issue sell alerts if something major changes with a business or their thesis. You mostly get “hold” guidance and new buy alerts, along with regular updates on each pick.

What is the best stock advice website?

There’s no one-size-fits-all option, but The Motley Fool is at the top of the list for individual investors who want long-term stock picks with solid research. Competitors like Morningstar, Zacks, and Seeking Alpha each have big followings too. Try a few and see which style fits you best.

Who owns Motley Fool?

The Motley Fool is a private company, mainly owned by founders Tom and David Gardner plus longtime employees through equity and stock plans. They don’t have outside shareholders, so they keep control of business and editorial decisions.

Is Motley Fool Right for You?

Here’s my bottom line. The Motley Fool is a great resource for regular investors who want actionable stock ideas, solid research, and easy-to-digest guidance without being bombarded by technical jargon. Their premium services aren’t magic—every investment carries risk—but if you’re playing the long game and want to learn along the way, their advice can be super useful.

If you’re not ready for a paid service, start with their free content. Read up on investing basics, get a sense of their approach, and see what you think. If the vibe fits and the research makes sense, giving Stock Advisor a try for a year could pay off, especially if you stick around and keep learning in the process.

Already tried The Motley Fool or thinking about it? I’d love to hear your take or answer your questions down below. If you try any of the paid services, share your own results—other readers always appreciate firsthand feedback!